“Don’t fight the Fed” is one of the oldest and best-known nuggets of investing wisdom out there, but do people really understand it?

I have my doubts. Coined more than 50 years ago by the late, great Martin Zweig, who warned investors to be cautious ahead of the October 1987 stock market crash, it basically means that, when the world’s most powerful central bank puts its finger on the scale, you would be wise to be on the same side. Buy when policy is loose, be cautious when it is restrictive.

But something can go from being a novel and useful insight about markets in 1970 to such a piece of conventional wisdom in 2024 that it is best ignored. You might even want to bet the other way by taking some chips off of the table. (Hey, you’re something from the publisher of “The Hungarian Contrarian”–what were you expecting?).

My column this weekend made that point by comparing the faith people have in Jerome Powell sending stocks soaring to new highs to the blind belief Dorothy and her companions initially had in the Wizard of Oz. There was initial excitement in the market, but, as has been the case the last couple of times a bull market was long in the tooth, the market might soon conclude that the man behind the monetary curtain frantically pulling levers isn’t really so “great and powerful.”

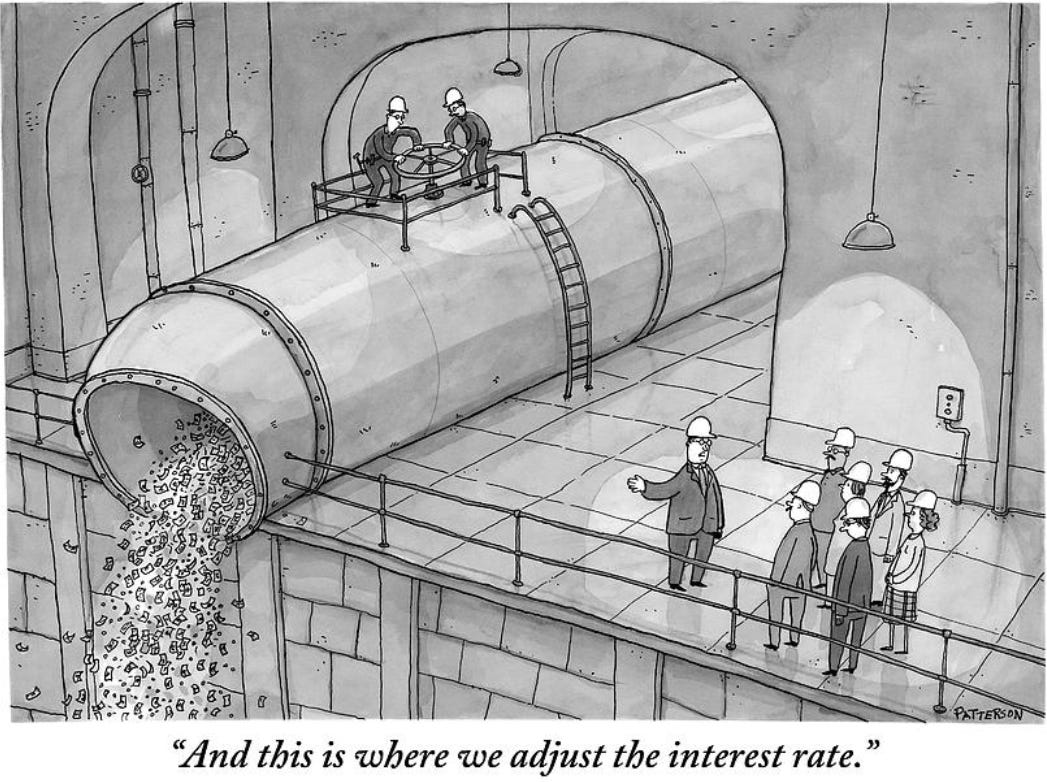

Back in Zweig’s heyday the Fed just had to lean in a certain direction to make markets move and individual investors weren’t parsing every word. For 25 years now–ever since the Fed opened the spigots to save the financial system following hedge fund Long Term Capital Management’s collapse–it has repeatedly ridden to the rescue in an increasingly aggressive fashion. That has reinforced the expectation that whatever leads the Fed to be concerned enough about the economy that it might cut rates, or stop raising them, is great for stocks. Once upon a time a disappointing report on the labor market was unequivocally bad news. Now it often sends stocks rallying. When cause and effect are that muddied it should give investors pause.

Why? For one, monetary policy isn’t some sort of magic wand. It takes quite a while to filter through to companies and individuals and to have an actual effect on corporate profits. If the economy is already weakening and valuations high at the outset then the start of a cutting cycle can be a massive head fake.

From my column:

Take the start of the rate-cutting cycle in 2007—one that coincidentally began on the same day of the year, the same starting federal-funds rate, and was for an identical amount, half a percent (50 basis points)—as Wednesday’s move. The effect was electric: The Dow Jones Industrial Average had its largest gain in more than four years, rising 336 points, the equivalent of about 1,000 points today. Lehman Brothers shares were among the top performers, surging 10%.

But, as we know now, stocks were just three weeks from their bull-market peak, a recession would begin in January 2008, and Lehman would collapse less than a year later in the largest-ever U.S. bankruptcy. By that time, the Fed had cut rates six more times—moves of 25, 25, 75, 50, 75 and 25 basis points, in that order. The moves took rates to 2%, their lowest in nearly four years. In the two months following the Lehman panic, the Fed made three more steep cuts, slashing rates to zero (technically a range of 0% to 0.25%) for the first time ever.

Stocks surged then too, with the benchmark S&P 500 jumping 4.7%. The Dow’s gain of 360 points would be nearly 1,700 today. Yet they erased all of that day’s rally in less than a week and would go on to shed another quarter of their value before bottoming in March 2009.

To be clear, the conditions that existed during the housing crisis were extreme, sparking the worst U.S. economic downturn since the Great Depression. Extreme events are by definition rare, and most predictions of doom are false alarms. More money is lost bracing for bear markets than in them, even when they really happen.

Will history repeat? That’s doubtful–the conditions back then were extreme. The housing crisis sparked the worst U.S. economic downturn since the Great Depression. There are plenty of excesses now, but only limited signs that the economy might be headed for a recession at the moment. But starting valuations matter and, based on reliable long-term measures, stocks are more expensive than they have been more than 95% of the time over 150 years of history. They also have returned more than 35% since the Fed began to raise rates.

A few readers took my column as doom-mongering. It isn’t. I’m trying to puncture a silly narrative that a handful of people in Washington can take a decision that sends stocks soaring from all-time highs. That isn’t their job and, even if it were, they wouldn’t have the power to make stocks rise in perpetuity. The market’s initial rally means nothing. If life were that simple then recessions and bear markets would barely ever happen. In the past century alone there have been 17 and 22 of them, respectively. The Fed has existed during that entire period.

Don’t fight the Fed, but don’t speculate on stocks at record highs because you think it’ll bail you out either.