The year I graduated from high school, before I took my first class in the dismal science, I got a memorable economics lesson.

That winter I visited Communist Hungary, where my parents grew up. Unlike my previous trips, I was old enough to explore on my own and I spent hours walking around Budapest. I also was aware by then that the country had a sort of hybrid economic system—a blend of limited free enterprise and central planning dubbed “goulash communism.”

In terms of wealth, Hungary was about as poor as Mexico at that time, but it was ahead of even the U.S. on some measures of human development—things like crime and education.

In terms of the environment, sadly, the system was a failure. Air pollution back then was 30 times the “acceptable limit.” Since there was no independent media. When Chernobyl, about 700 miles away exploded nine months earlier, word only spread when western radiation detectors picked up the signs days later. A group called Duna Kӧr, started that decade to oppose a controversial dam on the Danube along the border with then-Czechoslovakia, presented an early challenge to Communist rule.

Hungary was relatively prosperous within the Eastern Bloc. You knew there were tens of thousands of Soviet troops somewhere, but they mostly weren’t allowed to leave their barracks, in part because they’d be shocked at how easy it was to buy food and many consumer goods. That made it a lovely place for someone with dollars and able to speak the language in the 1980s. By contrast, even in 1992 when I was backpacking through Russia and Ukraine, I was vastly wealthier (600 rides on the Kyiv Metro for a buck), but I found hardly anything I wanted to buy.

It was possible to make a good bit of money in Hungary in the late 1980s through limited private enterprise. The vast majority of people lived in a parallel economic reality, though, where having a telephone at home was a major bureaucratic achievement.

I remember walking into an auto showroom where the various Eastern Bloc models were on display. It had salespeople, but it might have been the easiest job in the world: Next to each model there was a price and then the number of years you’d have to wait to get the car.

At the top of the list was the relatively new Lada Samara, the most-modern car ever built in the Soviet Union, described by Car and Driver magazine as “early Hyundai” producing “noises that would shame a John Deere dealer.” I can’t recall the price, but the wait was 15 years. The price was lower but the wait identical for the Lada “Zhiguli,” based on a 1960s Fiat 124. (I would buy a used 1986 model in 1993 for $1,400—my Hungarian-American friend Peter and I shared it and paid $700 each). Everything in it broke except the engine and transmission and the heat was on full blast all year. Cool car, though—this is how it looked:

At the bottom of the list was the Trabant, East Germany’s car of the year in 1957 and every year after that. Appearing on many lists of the worst vehicles in history, it was made of something called duroplast instead of metal and had a two stroke, smoke-belching 24 horsepower engine you’d only find on a lawnmower today. I could have bought one about 10 years after spotting it in the showroom for around $120 (vetoed by Mrs. Jakab 😢). I wrote a Wall Street Journal cover story about people who imported them to the U.S. out of nostalgia. In 1987, though, the waiting list was eight-and-a-half years.

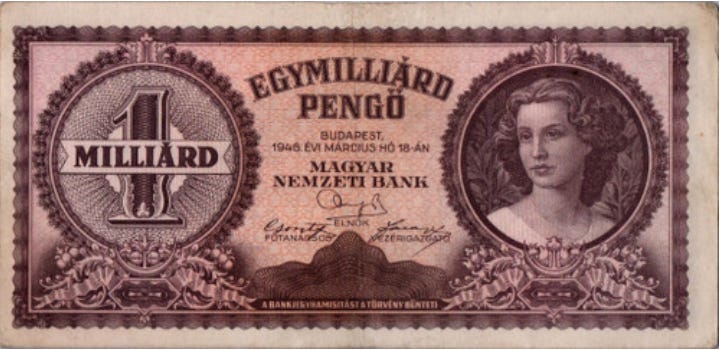

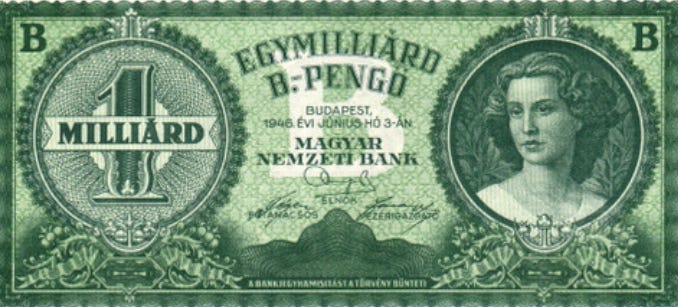

Here’s Ronald Reagan with a joke about the Soviet car salesman.

Around that time—the last couple of years before the Iron Curtain fell—some young, entrepreneurial Hungarians took full advantage of the wacky economy. Two close friends I’d meet at work six years later, both of whom are a couple of years older than me and who were university students in East Germany at the time, exploited mismatched Eastern Bloc currency prices and exchange rates and Hungary’s relatively lax travel requirements to make small fortunes. They flew as far away as China or Cuba—any place in the Communist orbit—to their hearts’ content. But they would have been poor as soon as they crossed into the West.

When I moved to Hungary in the early 1990s, armed with lots of graduate courses in how economies are supposed to work, I got several new lessons of how they did in practice. Lots of things existed then that barely do now because they aren’t worthwhile.

For example, when I was backpacking in St. Petersburg in 1992 a smart U.S. grad student asked me about the economic differences between Russia and Hungary, which seemed vast on the surface. He asked if there were people who repaired zippers in Budapest. Yes, all over—that and all kinds of things. He said it was a sign of an underdeveloped economy because it still was worth someone’s considerable labor to do that rather than for people to buy a replacement. A coat or pair of jeans traded at a world market price and was very expensive.

When I moved to Budapest, I hesitated to tell friends in the U.S. my starting salary because it was so low—the temporary price of bypassing U.S. HR departments to get a job there. But my pay was a lot higher than family friends more than twice my age who mostly had advanced degrees. Back then it was totally normal for someone in Hungary to ask what your salary was because they all were pretty similar. I had to tie myself in knots to avoid giving a straight answer and embarrassing them.

But it was a fascinating and fun time for me—exactly the reason I went to live there and why I traveled all around the region. I used to keep track of things like how many McDonald’s each country had and when I’d go for a walk somewhere I’d count the percentage of western-made cars, which rose gradually. On my last trip to Hungary I still spotted a few Polish, East German and Soviet ones, which is sort of amazing.

After moving to Budapest, I wanted to lose my accent and practice my Hungarian as much as possible so, in addition to speaking it most of the day, I got a TV to watch after work. There was a cable in my apartment that allowed you to view a few channels in German or English, but I unplugged it so that I’d be forced to watch the two domestic terrestrial channels.

The cheapest color TV you could buy was an Orion—a Hungarian brand. It cost about as much as a TV would have in the U.S., whereas import taxes made a Japanese SONY, Finnish Nokia, or German Grundig quite a bit more expensive.

It gave me a lesson in the folly of import substitution. It was just so inefficient for Hungarians to make TVs or Russians to pay Fiat to license an obsolete model from the 1960s. Likewise, the only way people would buy a U.S. made iPhone, which would come to about $3,500, would be if every competing device was taxed enough to make them more expensive too.

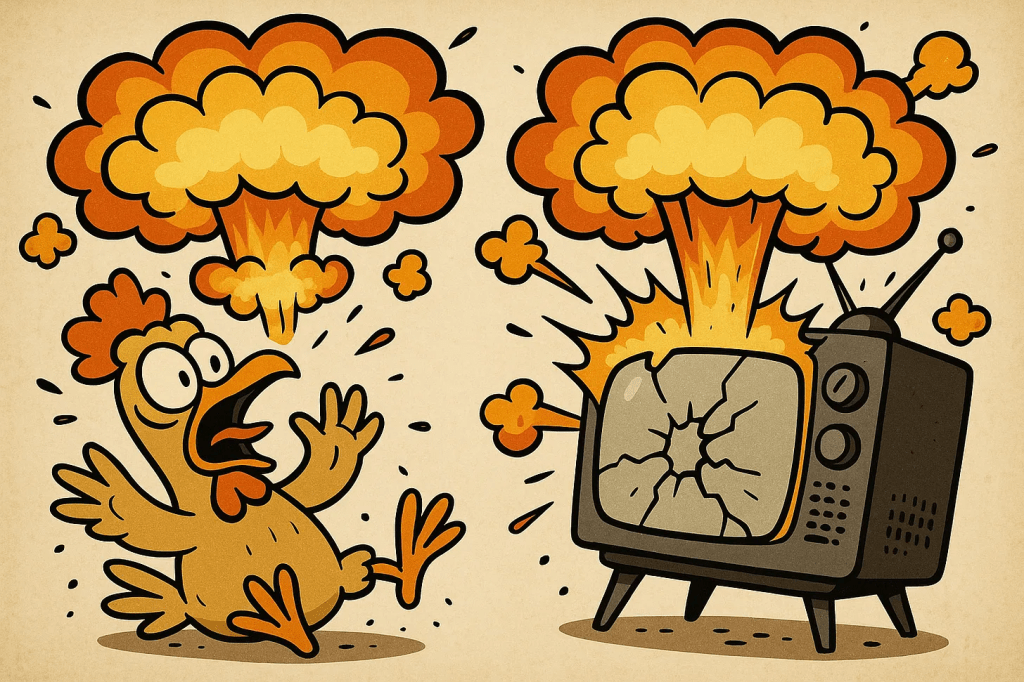

At least the domestic iPhone would be a desirable brand, though. I mentioned to people at work what TV I got and a couple said, with a slight look of concern: “Hmm, it’s probably okay.” Apparently a shortage of Japanese transistors had forced the company to substitute Soviet components that had caused several Orions to explode, but they figured mine was probably new enough that it wasn’t an issue. Other than the vague fear of burning down my apartment, and the fact that the remote control was a random series of tiny, unlabeled color buttons, it was a fine TV that I had for years.

Money was very tight for me initially as I had to pay American student loans on that modest salary. One way to save money was to buy something called “exploded chicken.” Unable to scrounge up enough hard currency, Russian importers had suddenly stopped buying certain Hungarian food products.

They don’t seem to have been discerning clients since one big poultry factory’s machinery was broken and they would just put cooked chicken with broken bones in a thick metal can with Cyrillic writing on it and sell as much of it as the former Soviet Union would take. It showed up in Hungarian markets and I think it cost about 40 cents. Artist’s impression of me in 1993:

As long as you didn’t mind picking out slivers, it was an okay dinner. I imagine tariffs that seem to change by the day will result in a few shortages in one part of the world and bargains elsewhere.

Free trade is underrated.