Mostly finance, a little silliness, all of it in the WSJ

Will Stocks Crash in 2026?

For Heard on the Street, I asked the 64 trillion dollar question: Are we headed for the big one? This is a common investor concern any year, and the good news is that pros and amateurs alike vastly overestimate the chances of stocks plunging. A typical guess is a 30% likelihood of a 30% or greater drop, but history (and the options market) put the probability much lower. The bad news? they’re a bit higher than usual at the moment.

How Strategists Tell the Future

One secret to being a successful prognosticator? Never mention a number and a date in the same sentence. Sadly, Wall Street strategists don’t have that luxury. I wrote about how they operate, why their forecasts are so wrong, and why average stock market returns don’t mean typical ones.

Baby, Can You Drive My Car?

Can you row your own gears? Few Americans—particularly young ones—can drive a stick shift any more. This Page One story, featuring a photo of an amused valet successfully parking my Subaru for five bucks, talks about the lost art and how it’s creating a dilemma for fancy restaurants, hotels, and country clubs. Fewer than 1% of cars sold in the U.S. are manual, but that still isn’t zero. How do they find young people who won’t burn up the clutch? Read about the “VIP” treatment owners of manuals get, whether they want it or not.

Why ‘Free’ Stock Trading Is Expensive

Hundreds of Oprah fans got a nasty surprise 20 years ago. In the most iconic moment of her talk show career, she delighted audience members with a free Pontiac G6: “You get a car! You get a car! Everybody gets a car!”. They also got a tax bill, with many having to sell lightly-used vehicles to pay for them. I explain why the move to zero-dollar commissions has been costly too for unsuspecting retail investors.

We Could Use a Good, Long Bear Market

How often do you get to use a classic line from “The Godfather” and annoy people with poor reading comprehension? This was a rare two-fer. My point: The lack of a really major selloff experienced by most people on Wall Street, or savers much below age 40, has bred dangerous investor complacency. There was a bit of hate mail.

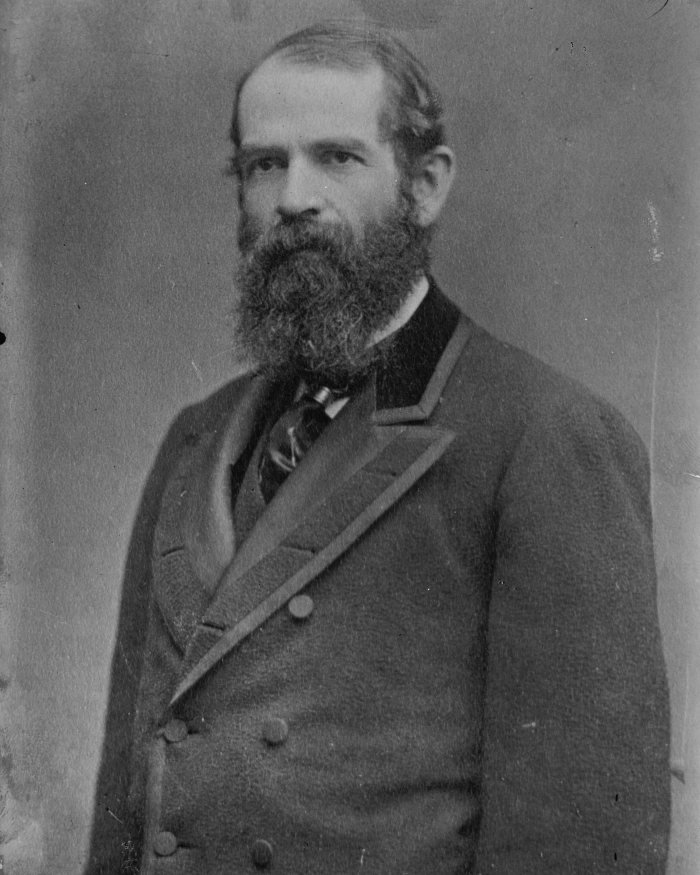

Great Cons Are Part of the American Story

Speaking of hate mail (preceding article), this one blew that and anything else I’ve ever written out of the water, though I got some very nice notes too. It was written for the WSJ’s USA250 series celebrating a quarter millennium of American capitalism. Part of the secret sauce, I argued, was that the rules are a little bit fuzzy—a legacy of English Common Law and our “anything goes” frontier mentality. Some businesspeople just toe the line and others go way over and get away with it. Recently a few went to prison for a brief while and get a presidential pardon. Pictured above is Jay Gould, the “Mephistopheles of Wall Street,” who upset a few people, built railroads, and helped spark a financial panic, but died a free man.

Sorry, We Don’t Employ an ‘Iron Man’

Have you ever run across a company that had the same name as a fictional one and wondered if it was on purpose? Sometimes it is. Hilarity, and occasional fear of lawsuits, ensue. I wrote about iniTech, Cyberdyne, Stark Industries, Virtucon, Wayne Enterprises, Bluth Construction, Pied Piper, and, yes, Vandelay Industries.

Would a Time Machine Make You a Great Investor?

If you haven’t dreamt of going back in time and buying bitcoin for a penny or Apple stock when it was on the verge of bankruptcy, well, you either lack imagination or aren’t really into money. But if you’re a greedy bastard like myself, the next best thing would surely be reading tomorrow’s Wall Street Journal today on a consistent basis. Right? The surprising answer is that, minus the actual stock and bond prices, it isn’t. Like not at all.

Box Office Flop Spawns Generation of ‘Midnight Madness’

This is an old one, but I’m including it because it’s the story I had the most fun writing ever. I’ve seen this film 30 or 40 times and the idea to write about it was sparked by a question one of my sons asked as he and I and his brothers sat down for what was probably our 10th viewing. “Dad, what do you think Leon is doing now?” That’s him above in 1979, and I got to meet the actor from this cult classic as a result of writing this and to attend a re-enactment of sorts.

How To buy a Week in Paradise for $1

Back in 2003, after I moved back to the U.S. with my wife and young kids, I happened upon an ad for a week’s getaway in Florida for what seemed like a steal. There was no catch: An owner of a timeshare week was desperate to rent it out to cover his fees. I’ve since become very interested in the upside down economics of timeshares and finally wrote about it for this article. Many, including some gorgeous places, now can be bought outright for nothing (not that I’d recommend that since you’re then assuming the liability).